Compounding is also known as the eighth wonder of the world. A tiny portion of your earnings can turn into immense wealth if compounded efficiently. In layman terms, compounding is about creating wealth through earning interest on interest i.e. reinvesting your returns to earn interest on your returns.

For a long time, compounding has been a topic of discussion among investors and economists alike. Though it is a very simple concept, still a lot of people are unaware of its power. So, in this article let us explain compounding and its power with the help of an example.

An example

Suppose, there are three friends: Aditya, Arjun and Sai, and all three of them are of the same age.

Starting at age 20, Aditya invests ₹5,000 each month into a mutual fund, and he continues to do so for the next 10 years i.e., until he reaches age 30.

Whereas, Arjun thinks that at his age he should spend his money on buying the stuff he wants and partying rather than saving and investing and hence, he did not start investing until he reaches age 30. At age 30, Arjun starts investing ₹10,000 each month and he continues to do so until he reaches age 45. Whereas Sai starts investing at age 40 and he invests ₹20,000 each month until he reaches age 60.

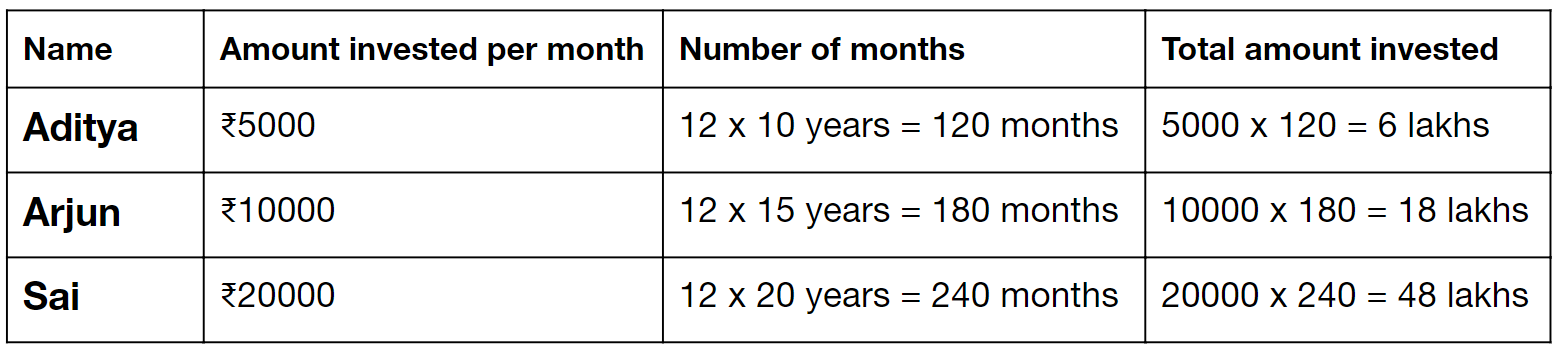

Following table represents the total amount invested by each one of them.

Now, to simplify things, let’s assume that each of them invests in a mutual fund which gives them 12% returns per annum. Yes, we know you can get higher returns than this, but let’s take 12% for now. Also, all three of them withdraw the amount only when they reach 60 years of age.

What do you think the value of investments for all three of them will be when they reach age 60? You must be thinking that Sai has invested the largest amount, and hence the value of his investments must be the greatest when he reaches age 60.

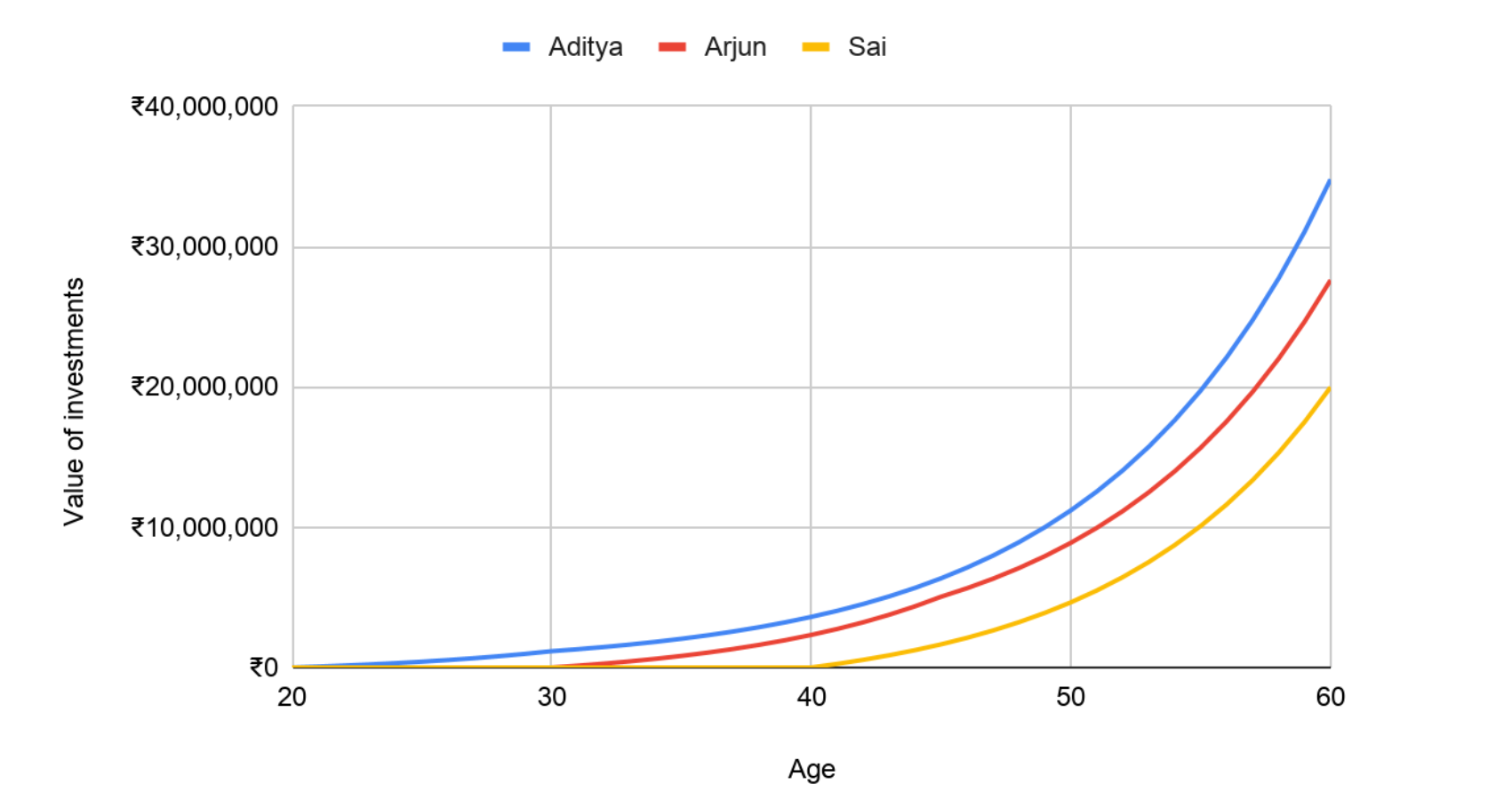

Well, let’s see the graph below which shows the total value of investments for each of them with their age.

Surprised, aren’t you?

As Aditya has kept his money invested for a much longer period, it gave enough time for compounding to play its part. His total investment of ₹6 lakhs went on to become a whopping ₹3.84 crores, when he reached age 60. Whereas, Arjun and Sai didn’t have enough time to take full advantage of compounding. Yes, the value of their investment also increased, Arjun’s investment of ₹18 lakhs increased to ₹2.76 crores and Sai’s investment of ₹48 lakhs increased to ₹1.99 crores, but they still are far behind Aditya.

The Conclusion

Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

The example above clearly portrays the value of time in investing and what we can learn from this is - it is never too early to invest and the early you start your investment journey, the better opportunity you get to make the most from your capital with the help of compounding.

There is no right time to start investing, instead we advocate that the best time to invest was when you were 18 years old and the next best time is today.

However the key to creating wealth is by being patient and giving your investment enough time to grow. Just like a seed takes its own time to turn into a tree so that you reap its fruits, the same goes with your investments and its exponential growth.