If you have been following our previous articles then you must have learnt about the need of investing, the advantage of starting early, risk profiling, financial planning and asset allocation. We hope you decided to start investing but then you would have realised that there are two ways through which you can invest in mutual funds i.e. lumpsum investment and SIPs. In this article, we will look at both the ways in which you can invest in a mutual fund and how to decide which one is best for you.

Lumpsum investment Vs SIP

A lumpsum investment is depositing the entire amount at one go. For example, you get a bonus of ₹50,000 and you invest the complete sum at one go, then it is called lumpsum investment. It is a common mode of investment for HNIs(High Net-worth Individuals) and big ticket investors.

SIP stands for Systematic Investment Plan. It is a facility offered by mutual funds to invest in a disciplined manner. It allows you to invest a fixed amount of money at predefined intervals in the selected mutual fund scheme. This fixed amount of money can be as low as ₹500, and the fixed interval can be weekly/monthly/quarterly/semi-annually or annually.

SIP has been gaining popularity among the mutual fund investors, as it helps in investing in a disciplined manner without worrying about market volatility and timing the market. SIPs offered by Mutual Funds are the best way to enter the world of investments for the long term.

Comparison

Let’s suppose there are 2 persons, Person A and Person B. Both of them had invested ₹1 lakh for a 5 year period in 2016.

Person A invested this amount as a lumpsum investment, whereas Person B chose to do a monthly SIP of ₹10,000 and invested the complete sum over the period of 10 months. Also, let’s assume that both of them invest in the same mutual fund scheme: Mirae Asset Emerging Bluechip Fund.

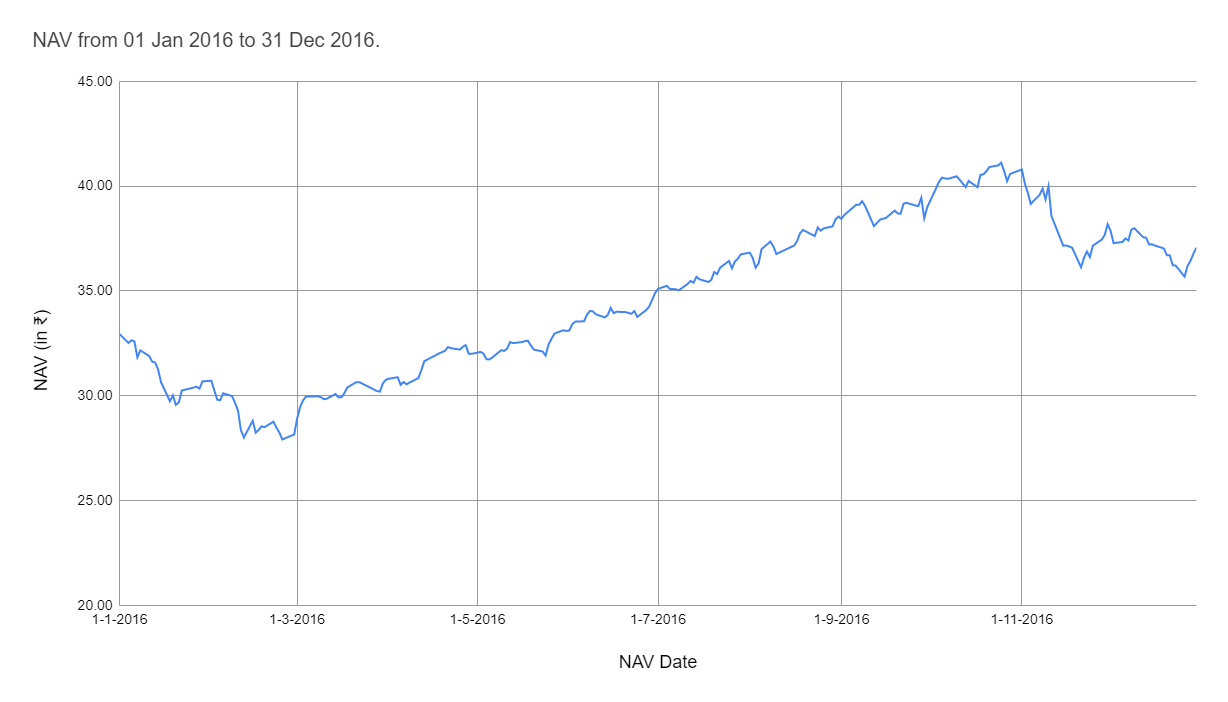

If person A invests ₹1 lakh in this scheme on 26th Feb, he would receive the mutual funds units based on the NAV of the scheme on that particular date. Now, the date 26th Feb, is the day in 2016 when this scheme had the lowest NAV (₹27.10) and hence Person A would get more units than he would get if he had invested on any other day in the whole year.

The NAV on 26 Feb was ₹27.10, so by investing 1 lakh in this scheme person A would get 3690.04 units (100000/27.10 = 3690.04 units). Whereas, if he invested on 25th Oct 2016, which is the day on which this scheme had its highest NAV in 2016 (₹39.62), he would only get 2523.98 units (100000/39.62 = 2523.98 units).

If person A had invested on 26th Feb 2016, and then if he redeems his units on 28th May 2021, he would earn a profit of 211%. Whereas, if he invested on 25th Oct 2016 and sold these units on 28th May 2021, he would only be able to earn a profit of 112.8%.

Whereas person B who just started a SIP which auto-debits ₹10,000 from his account and invests it into this scheme on 11th of every month from January to October would earn him a profit of 161.5% over the same period.

So, the returns of lumpsum investment greatly depend on how well you time the market. Timing the market is very vulnerable to the handful of good days and bad days in the market. Over a period of next 10-20 years, there will only be very few days when the markets will either spurt sharply or correct sharply. If you miss out on these good days or if you happen to buy on the bad days, your timing concept can greatly underperform. This is what actually happens when you try to time the market. There is an old saying that, Time in the market is more important than timing the market.

Whereas, SIP can give you good returns over a long period, without you worrying about timing the market. This is called rupee-cost averaging.

Rupee-cost averaging helps you beat market fluctuations and makes your investment averse to market volatility. When the market hits rock-bottom, SIP allocates you more units, and allots lesser units when the market is high thereby, averaging out your savings.